How Does Microsoft Make Money: Business Model Explained

Microsoft (MSFT) is one of the biggest companies in the world. It is known mainly for its Windows operating system and Office productivity tools. But are those two products still the main ways how Microsoft makes money?

Microsoft makes money by providing cloud resources and a wide range of software to businesses. Some of its products are also used by consumers, but business customers are Microsoft’s core focus and the primary source of its $198bn annual revenue. The only sizable exception is Microsoft’s Xbox platform.

The paragraph above might sound a little too general, and I agree. I will get to a more detailed breakdown of the business model and different products and services Microsoft offers later. The main point I want to make here is that business customers are at the center of nearly everything Microsoft does.

The range of products and services Microsoft offers to businesses ranges from backend infrastructure used mainly by developers to productivity tools that help business users to do their job.

Business customers are the primary source of its $198bn of annual revenue and also the main driver of how the company resources are spent. This was true before, is true now, and will be true for the foreseeable future.

That being said, that does not mean consumers are not essential to Microsoft. They are. Microsoft has many reasons to care that consumers love its products, and it simply cannot afford to ignore consumers.

It makes perfect sense for Microsoft to offer Office, Teams, Windows, and other tools to retail customers for reduced price or even for free. Not only because it means additional billions of revenue without too much additional expense, but familiarity with Microsoft’s products among consumers is even more important than the relatively small revenue it is bringing in.

The only sizable part of Microsoft where consumers are the core focus of its business is gaming. Microsoft earned $16bn revenue from gaming, which represents 8% of its total revenue.

Gaming within Microsoft is mainly about its Xbox platform. For a long time, gaming looked like a weird fit for business-focused Microsoft. After years of trying, Sony was and still is way ahead of Microsoft in console sales market share. The synergies of Microsoft and Gaming were not obvious.

After many recent smaller gaming studio acquisitions by Microsoft and the introduction of Game Pass and Xbox Cloud Gaming, it became much easier to see an opportunity there. Recently, Microsoft decided to push into gaming even more by acquiring Activision Blizzard, a renowned developer of popular titles like World of Warcraft, Call of Duty, Candy Crush, and others.

Let’s now get more clarity on how much money Microsoft makes and the main revenue sources before digging deeper into how Microsoft earns money, its business model, and its revenue model.

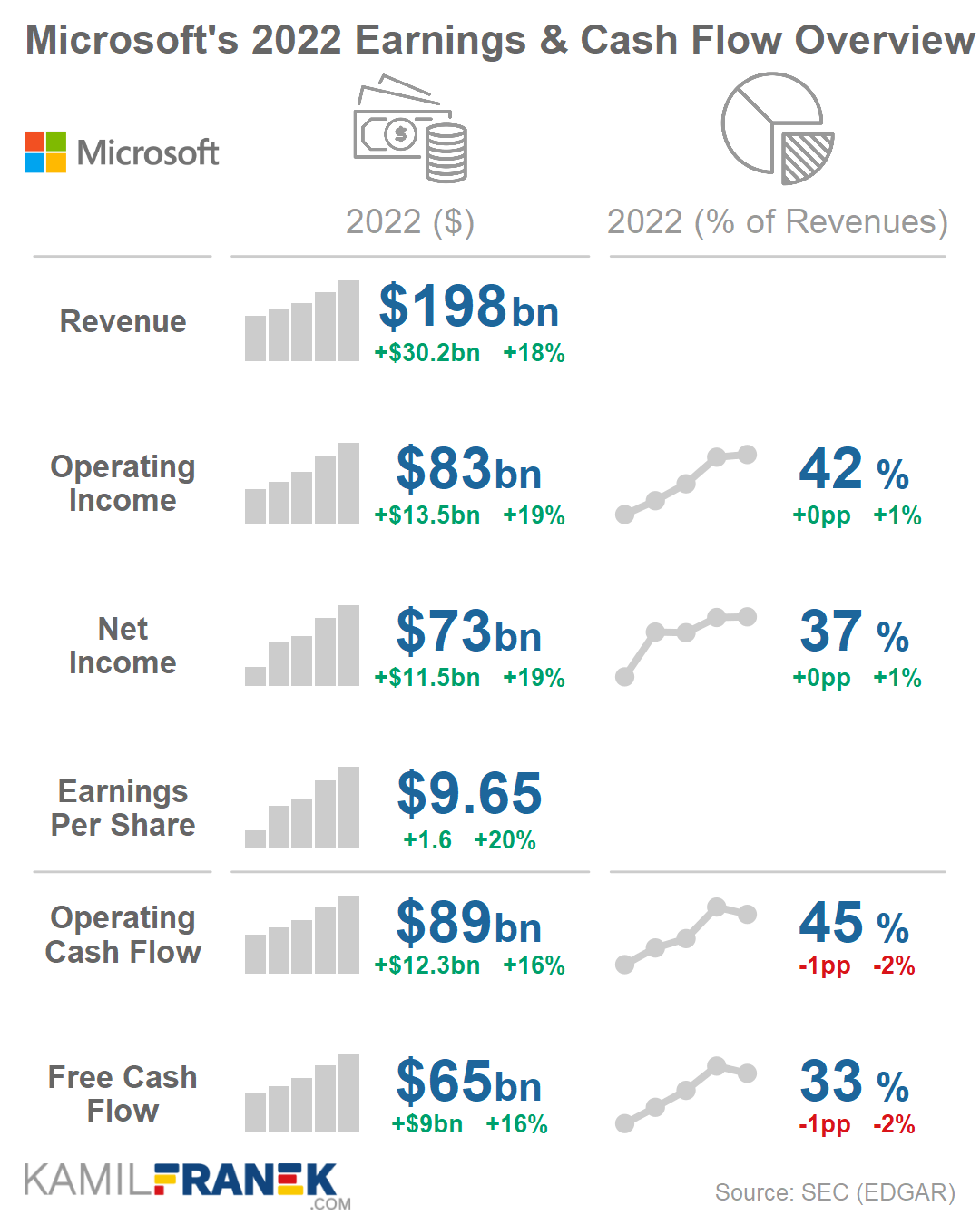

Microsoft earned $198bn of revenue in 2022, and $72.7bn was net profit after taxes. The operating margin stayed at respectable 42%. The main revenue sources were Server Products & Cloud Services (34% of revenue), Office products and services (23%), Windows (12%), and Gaming (8%).

Looking at the trajectory of Microsoft’s results above, it seems that Microsoft somehow defies gravity. It is growing in revenue and profits and has expenses well under control, resulting in increasing margins.

These trends result from successful bets on cloud infrastructure and cloud-based software. Looking forward, it is hard to see a significant change in those trends. The underlying shift of businesses to the cloud, both in backend infrastructure and productivity tools, is poised to continue. Microsoft is well-positioned to benefit from that.

“What we are witnessing is the dawn of a second wave of digital transformation sweeping every company and every industry. “

— Satya Nadella, CEO of Microsoft, Earnings Call in January 2021

Microsoft will also benefit from other areas like cybersecurity, a sizable market. Large global providers like Microsoft have logical advantages there.

Another increasingly important part of Microsoft solutions is artificial intelligence (AI). Both in the form of specific Azure services used by developers and, more importantly, as an inherent part of all products that Microsoft develops. AI focus is also behind the acquisition of Nuance Communication for nearly $19bn.

“We are rapidly innovating in AI, and our large scale models are powering everything from meeting recaps in Teams, to helping developers code in GitHub, to “next best action” in Dynamics 365.”

– Satya Nadella, CEO of Microsoft, Earnings Call in October 2021

Microsoft is currently one of the largest companies in the world, with a market capitalization around $2 trillions. Only Apple and Saudi Aramco are larger than Microsoft, but not by much.

Microsoft is flying high right now, but although it has been dominating force in technology for several decades, it went through some tough years roughly a decade ago.

The world of computing and software was quickly changing at the time, and Microsoft seemed too slow to adapt. It was not only the smartphone revolution that threatened the dominance of the Windows operating system but also the growing popularity of cloud-based software.

The threat at the time was that Microsoft could be left behind thanks to more nimble competitors like Salesforce or Google. These companies adopted cloud software more aggressively, and its managers at the time openly called Microsoft the “dinosaur.”

The issues Microsoft had were not so much visible in its financials. It was still earning vast amounts of money from Office and Windows, but the future of Microsoft looked bleak, and the market value of the company reflected that.

It all culminated with Microsoft’s Nokia acquisition, which turned out to be a desperate attempt to keep Windows and Microsoft relevant in smartphone operating systems. It did not work out. Nokia acquisition can be seen as a low point in Microsoft’s history.

Since then, things started to turn around, and Microsoft managed to pull one of the most successful corporate turnarounds in history. Microsoft made a tough decision to exit the smartphone business, which was already dominated by Google and Apple and focused predominantly on business customers.

Microsoft managed to transition Office to cloud-based service and heavily invested in Azure cloud, which now captures 21% market share, second only to AWS with 33% share. Microsoft also introduced a range of new products like Teams or Power BI, which captured market share quickly.

Microsoft is now back at the forefront of business software, and many of the same companies that called Microsoft a “dinosaur” are the ones struggling to keep pace with Microsoft.

I tend to think that Microsoft is still a dinosaur. But a dinosaur that is well alive, hungry, and going after its competitors aggressively.

The person who became the face of Microsoft’s turnaround is its , Satya Nadella. He became CEO of Microsoft in 2014, replacing Steve Balmer. At that time, giving the CEO’s job to Nadella was a bold move as he was mostly unknown outside Microsoft. Despite that, after a while, Microsoft started to gain the lost ground and got back on track.

Satya Nadella deserves a lot of credit for executing Microsoft’s turnaround. Nadella embraced open source and significantly changed Microsoft inside by breaking the silos and making it more cooperative. Microsoft is now again a company that is cool to work for. It is no surprise that soft-spoken Satya Nadella is one of the most-loved CEOs.

But correlation does not mean causation. The fact that is sometimes forgotten is that the turnaround that Nadella managed to execute so well was partially initiated before Nadella became CEO.

It was Steve Balmer that started the reorganization of Microsoft into a more cooperative and holistic company with more focus on cloud and services. In the video below, Nadella himself acknowledges this.

However, after pressure from Microsoft’s board and shareholders on the speed of this transition, it soon became apparent that some new face would probably be a better fit to manage this transition.

“Maybe I’m an emblem of an old era, and I have to move on,”… “As much as I love everything about what I’m doing,”.. “the best way for Microsoft to enter a new era is a new leader who will accelerate change.”

— Steve Balmer, WSJ Interview, 2013

In the rest of the article, I will dive deeper into how Microsoft makes money. We will dive into different parts of Microsoft’s business model and break down its revenue model.

If you are primarily more interested in diving into a guided tour of Microsoft financials, I wrote a separate article focused on Microsoft’s financial statements that I recommend you check out.

Or you can find out Who Owns Microsoft and who controls is.

💼 Microsoft’s Business Model

Microsoft’s business model is about providing cloud infrastructure and highly integrated software tools for business customers. Microsoft offers software that covers the most common business needs. It ranges from office productivity apps to tools used by developers to build their own software.

Microsoft’s business model and how it makes money differs based on product segments. Office productivity tools are mainly subscription-based, Azure is primarily about paying based on consumed resources, Windows is still about selling per PC licenses, and Gaming is all over the place.

Microsoft’s range of products is so broad that we can see Microsoft as an operating system you can run your business on.

In the visual above, I tried to capture the main pieces of Microsoft’s business model. It shows Microsoft’s customers, the different channels Microsoft uses to reach them, and Microsoft’s main products and services.

You can see that I put Azure at the center of Microsoft as it is currently, in my view, the beating heart of Microsoft. Microsoft rents Azure capacity and associated services to customers, and at the same time, it uses Azure as a backend for many of its own cloud-based products.

Microsoft often touts the openness of its products and platforms. What it means is that you have the option to stay entirely within the Microsoft ecosystem of products and services, or you can integrate with third-party software tools or other cloud infrastructure providers.

However, at the same time, Microsoft makes sure that staying within the Microsoft ecosystem is the easiest choice for its customers. Microsoft’s ecosystem is relatively open, but it is at the same time as sticky as ever.

Great “sticky” products are not the only key ingredient of Microsoft’s business model. Microsoft also has a significant advantage in historical relationships, often very complex ones, with many companies.

These historical relationships give Microsoft an advantage when these companies start shifting their business to the cloud. Another thing that stands out in Microsoft’s business model is a very well-oiled network of salespeople, partners, consultants, and resellers.

Put all these things together, and it is not any more such a big surprise that Azure is catching up to Amazon Web Services (AWS) and Microsoft productivity tools continue to be the market leader with over 400 million paid Office 365 users.

Despite its focus on business customers, Microsoft still cares a lot that consumers use its tools. Microsoft even earns sizable revenue from consumer versions of its products.

However, more important than that direct consumer revenue is the familiarity of billions of people with its products and services. This familiarity then feeds back into its revenue from business customers because familiarity with the tool is an essential part of the decision of any business when deciding which set of tools they will use and pay for.

That’s why basic versions of Office 365 tools are free to use, and Microsoft is pushing Teams to customers so hard that it is now integrated into Windows 11.

One segment breaks the pattern of business-focused Microsoft, and that is gaming. Gaming looks like a weird fit for Microsoft, but we can find some interesting synergies even in gaming. After all, game developers are businesses too.

However, gaming is, above all, a sizable consumer business opportunity where Microsoft’s cloud infrastructure and direct ownership of many successful game studios puts it into a great position to take a more significant piece of gaming market profits for itself.

📊 Microsoft’s Revenue Breakdown into Streams

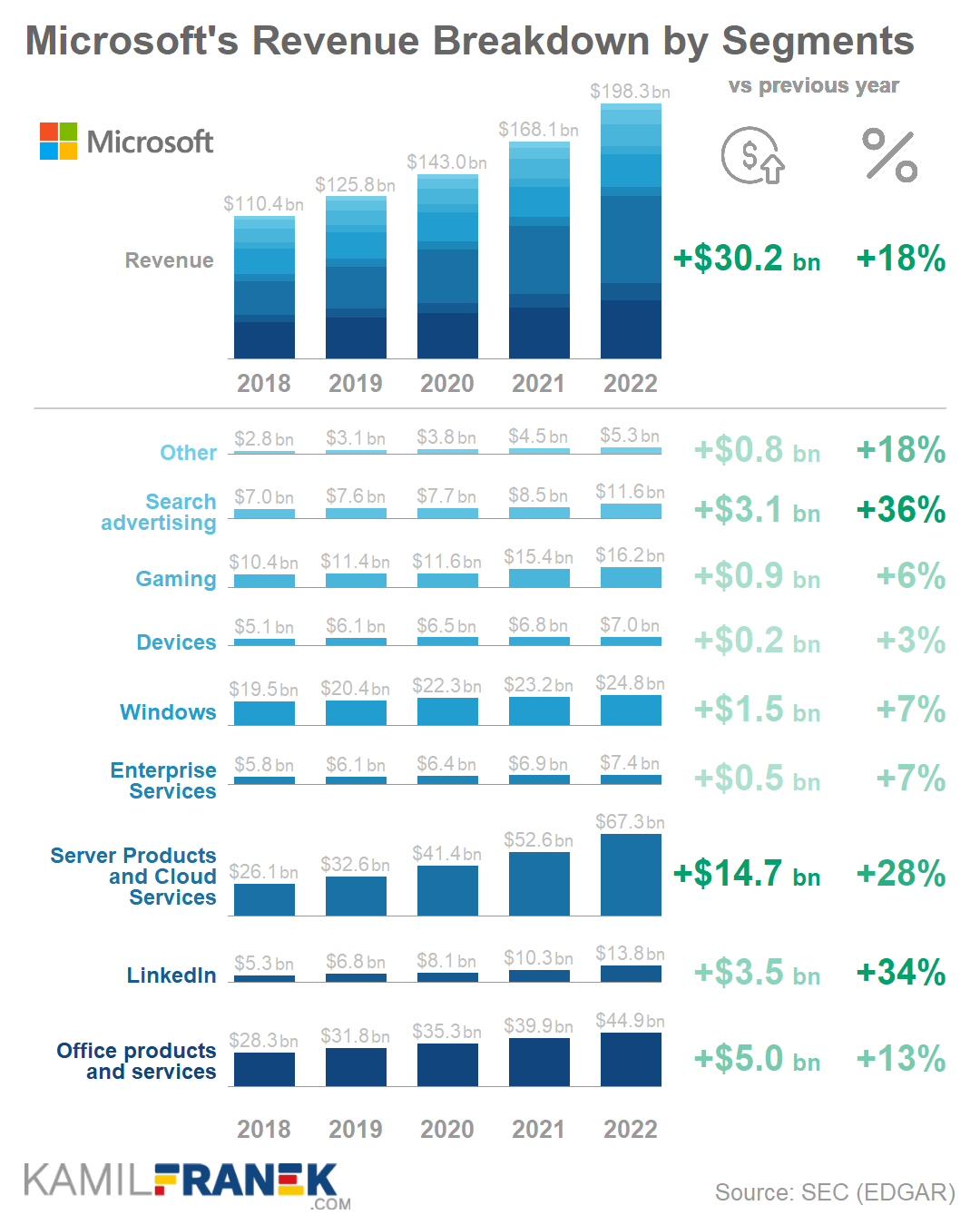

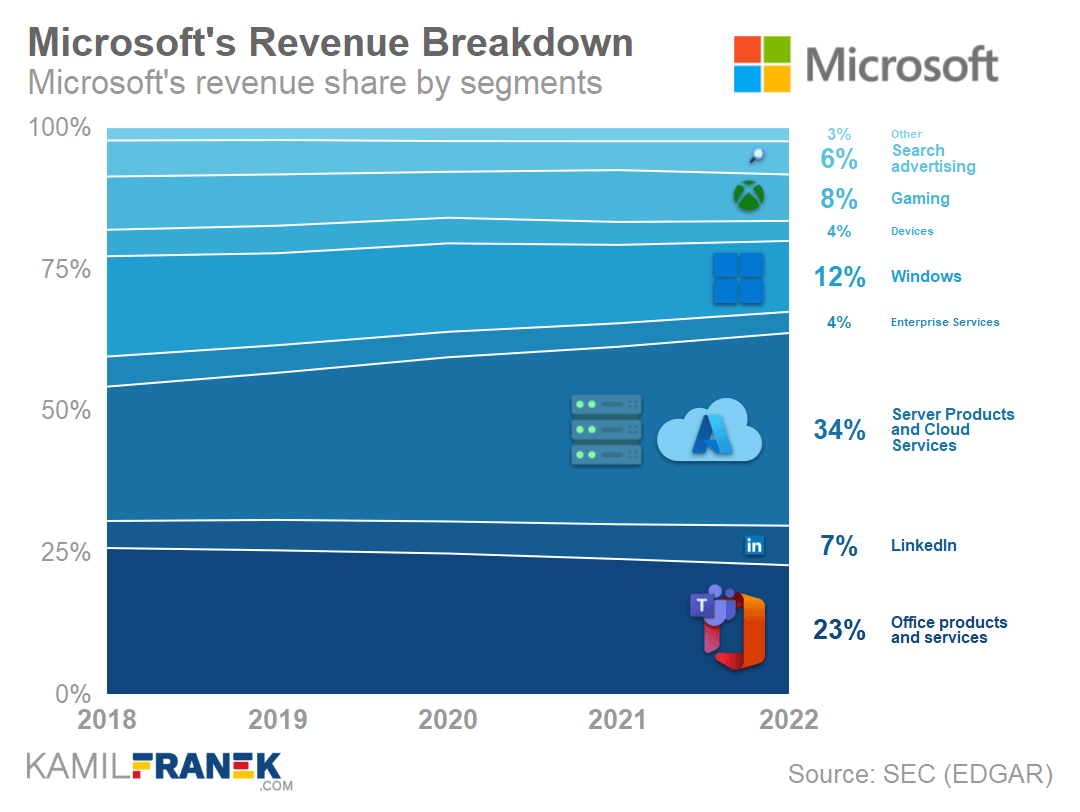

Microsoft’s revenue was $198bn in 2022. The main revenue streams were Server Products and Cloud Services with $67bn (34% share), followed closely by $45bn from Office productivity tools (23% share). Windows was in third place with $25bn of revenue (12% share).

The chart below details Microsoft’s breakdown into different revenue streams based on the product group.

You can see that Microsoft’s revenue has been growing significantly throughout the years across different product lines. Still, some of them are growing much faster than others.

Sever Products and Cloud Services is the biggest revenue stream ($67bn) and one of the largest contributors to revenue growth in the last several years. It grew by 28% in 2022. When we would look only at Azure Cloud services alone, the revenue growth was 45% in 2022.

Server products dragged down the growth rate of the whole Sever Products and Cloud Services category. Server products revenue was still growing but only by single-digit percentage points.

The second biggest revenue stream with $45bn in 2022 is Office, with “only” 13% revenue growth, which given how long the product is on the market, is also a very good result.

Windows, which was Microsoft’s core product for decades, is currently in third place in revenue ($25bn) and growing just in single digits. Its importance, at least for direct revenue, is decreasing.

This decreasing importance of Windows for Microsoft’s revenue is more visible from relative shares of each revenue stream on total revenue. Windows share on revenue has been decreasing throughout the years. It is still growing in nominal terms, but other revenue streams like Server Product and Cloud services or even Office are growing much faster, decreasing Windows’ relative share.

The numbers shown above are based on 2022 financials which did not include the recently announced $75bn acquisition of Activision Blizzard. If this huge acquisition comes through regulatory approvals, gaming revenue might in time be bigger than revenue from Windows, which will be a huge historic shift.

The main driver of Microsoft’s revenue growth is obviously Azure, which is part of the Server Products and Cloud Services product category. Azure is now the beating heart for Microsoft not only as a backend infrastructure that Microsoft products depend on but also as a revenue generator.

In 2022 Azure Cloud Services revenue (without Server Products) was $44bn, growing by 45%. Therefore it is nearly certain that next year, revenue from Azure will be higher than revenue from Office, Microsoft’s historical money maker.

This part was just a quick introduction to show where is Microsoft’s revenue coming from and which parts are growing at a faster pace and which at a slower one. Let’s now dive into how Microsoft makes money by exploring its business model and revenue model piece by piece, starting with customers.

If you want to dig deeper into Microsoft financials instead, check my article about Microsoft’s financial statements. or article breaking down Microsoft’s revenue by product, segment and geography.

🧑 Who Are Microsoft’s Customers? Where Does Microsoft Revenue Come From?

Microsoft’s core customers are businesses of all sizes, especially corporations and SMEs, to which Microsoft sells multiple layers of different products and services. Microsoft provides products and services also to consumers, but businesses are where most of the revenue comes from.

Despite being business-oriented, and the fact that revenue coming from consumers is relatively small, Microsoft’s most numerous users are consumers.

Mainly for products offered for free, like its basic version of Office 365 or products where consumers do not pay directly to Microsoft, which is the case of the Windows operating system, which is mostly preinstalled on consumer-focused hardware. There is currently 1.4bn devices with active Windows 10/11 running worldwide.

Besides businesses and consumers, Microsoft software is also essential for the nonprofit sector and governments.

Now let’s look at different customer segments one by one.

Large and Medium-Sized Companies

![]()

Microsoft is highly focused on business customers. That’s how they make their money. However, not all companies are equal, and some of them have more business potential for Microsoft than others.

Large and medium-sized companies are one of the most valued customers for Microsoft. That is not only because a large company usually means more money from Office and Window licenses, but it is also about the complexity of software and IT infrastructure for those companies.

For a company that grows above a certain size, you need to have some common platform through which you communicate and share documents. You also need to have backend servers on-site or in the cloud, and you will need software solutions for handling your data storage, data governance, and analytics needs.

If you do all those things, then on top of that, there is a need to protect those systems from threats from both outside and from inside the company.

In such a complex environment, where everything needs to be tightly knitted together and work seamlessly and securely, Microsoft thrives with its wide range of solutions. It is generally much easier to integrate one Microsoft product with another Microsoft product, even though Microsoft promotes its solutions as open.

It is often much simpler for a company with more complex needs to have just a few core reliable partners that are appropriately vetted with legal agreements chiseled out. An alternative would be managing many different tools tangled together, each from a different partner.

It is not that it cannot be done, but it is painful. And companies usually want to avoid that pain without sacrificing too much on what they want, and the price is not prohibitively higher.

The stickiness and pricing power Microsoft solutions have for large and medium-sized companies is especially obvious for companies that already have some Microsoft infrastructure or software.

When those companies need some additional software or infrastructure needs, and Microsoft has such a product within its Office 365, Azure, or Dynamics 365 range of products, that is, in many situations, the easiest and quickest route to get things up and running securely.

In this situation, Microsoft has a significant competitive advantage against competitors, and it drives them crazy. Even the ones that once called Microsoft a “dinosaur.”

There are several ongoing antitrust complaints against Microsoft. So far, without a clear result. One of them is Slack EU’s complaint against Microsoft for including Teams as part of Office 365. Another EU complaint is about Microsoft products being more expensive to run on other clouds than on Microsoft Azure.

The way how Microsoft services its large and medium-sized customers is very much dependent on their size and potential for future revenue.

For the most prominent companies, Microsoft has internal teams of salespeople and consultants that companies work with directly. However, most medium and large companies will probably be offered Microsoft products indirectly through many of its partners.

There is, of course, an option to buy Microsoft products through its website directly for anyone. But for larger and medium-sized companies, this option is too expensive and without an individualized contract.

Microsoft’s market position for larger corporate customers is strong, and Microsoft is pushing further by making both its Azure ecosystem and Office/Dynamics ecosystem of tools richer.

For example, Viva’s introduction suggests that Microsoft will try to enter people development and training tools, where it currently is not present. Apart from that, Microsoft is also now focusing more on cybersecurity solutions.

Large and medium-sized customers are such an important customer segment for Microsoft that I think we can generally expect that if there is any range of tools or infrastructure that these large customers will need, Microsoft will sooner or later introduce some products or services to meet those needs. Assuming that market will be big enough so Microsoft can make money from that.

Micro Businesses and Self-employed Customers

![]()

Small businesses with just a few employees and self-employed people like freelancers, lawyers, or consultants are also businesses. Still, that is a much different customer segment, and Microsoft approaches it differently. These are much smaller customers, but there are many of them, so it is still a sizable potential market for Microsoft.

Behind the apparent difference in size by simply requiring fewer subscriptions and licenses than large companies, this segment also tends to have more simple needs. It usually relies just on a few tools and does not have any large in-house IT solutions. That means less potential revenue per user for Microsoft than for much larger customers.

Thanks to the much simpler needs of this smaller customer, Microsoft’s main strengths are less efficient. There is no incumbent advantage here.

It is easier for these companies to switch from one tool to another. Microsoft is therefore much more exposed to direct competition between different products, both from established companies and many startups offering a wide range of subscription-based cloud software.

Still, Microsoft has a good range of products to offer here, like Office 365 or Power Automate tools that are at par with other products on the market. But there are also very easy to substitute even if Microsoft versions might be more advanced in certain aspects.

For example, on a direct comparison of functionalities of Office compared to competing online tools, Microsoft has an “advantage” of offering desktop apps giving better speed and much more advanced functionalities. Yet, this has no relevant added value for companies that do not need those advanced features.

Where Microsoft struck gold recently was the development of Teams, a product that experienced massive growth during the COVID-19 pandemic.

“Teams is rapidly becoming the de facto unified communications platform of choice for every organization.”

— Satya Nadella, CEO of Microsoft, Earnings Call in January 2021

On top of Teams being a successful product by itself, it is also becoming a new fast-growing platform for Microsoft. This can create advantages in the future for selling other products to Teams customers.

Microsoft is pushing Teams aggressively, and a simplified version of Teams is now integrated into Windows 11.

This market advantage that Tams brings to Microsoft did not go unanswered by competitors. Slack launched a complaint in the EU again Microsoft bundling Teams with Office.

Shortly after that, Microsoft’s old foe Salesforce, whose CEO Marc Benioff is known for calling Microsoft a “dinosaur,” followed by acquiring Slack for $27.7bn. Probably with a plan to create a similar productivity ecosystem that Microsoft managed to create with Teams.

There is also another difference between large and tiny businesses. This difference is in the channels Microsoft uses to sell to those customers and provide support, which is nearly identical to how it services consumers. If you are a tiny company with just a few people and no special IT needs, you can buy Microsoft products directly online or indirectly from resellers and online stores.

Software for smart devices is available to buy or download through third-party app stores. In the case of Windows, there is also the option to buy PCs from Microsoft OEMs partners with Windows already preinstalled and included in the price.

Governments & Nonprofit Customers

![]()

We also have to acknowledge governments & non-profits as a separate customer group. Their needs are very much in line with business customers. In the case of governments, it is in line with the largest corporate customers.

Besides regular software and cloud infrastructure needs, Microsoft gets involved in individual large government contracts. For example, they have an agreement with the US government that Microsoft will provide specialized AR glasses for the military.

Microsoft won the JEDI contract from the US Department of Defense worth $10bn before losing it based on Amazon’s complaint. Legal fights around the JEDI contract were so prolonged that in the end, the Department of Defense decided to scrap it and chose a multivendor approach instead.

Consumers - Gaming Customers

![]()

Gaming is Microsoft’s only purely consumer-focused segment. Users and paying customers significantly overlap, and therefore revenue comes directly from consumers. Gaming customers are mostly the users of Xbox consoles right now, but Microsoft’s strategy is to focus also on PCs and smart devices.

The main revenue driver is Xbox content and services, where Microsoft is getting revenue cut from third-party games sold on the Xbox platform and is also selling games made by its own game studios.

Significant revenue also comes from Xbox Gold subscriptions, which allow gamers to play online multiplayer games, and Xbox Games Pass subscription, which gives gamers access to hundreds of games for a monthly fee.

I should not also forget Xbox hardware, which, although not profitable by itself, brings billions of revenue each year and is an essential part of Microsoft’s gaming ecosystem.

Gaming seemed to be a weird fit for Microsoft for some time. Especially after Microsoft shifted its focus more on corporate and business customers after exiting the smartphone OS market.

But Microsoft clearly sees a business potential there and decided to pour a large amount of money into gaming by acquiring multiple gaming studios and then offering their games as part of the Game Pass subscription service.

Especially when taking into account Microsoft’s recent $75bn acquisition of Activision Blizzard, Gaming will be a very sizable part of Microsoft going forward.

Consumers - Non-Gaming Customers

![]()

I intentionally separate Gaming Customers and Non-Gaming Customers as different customer segments because they differ significantly in what products they are about and also how Microsoft approaches them.

Microsoft sells many of its products directly through online channels or 3rd parties to consumers. Revenue coming from consumer non-gaming business is not insignificant but relatively small compared to total revenue of $198bn in 2022. Consumer Non-Gaming revenue mainly comes from the same products that it offers to smaller business customers, just adjusted and packaged for consumer users.

Yet, it would be wrong to suggest that consumers are not essential to Microsoft. They are essential, just not solely because of their revenue.

Microsoft is willing to offer its products to consumers cheaper or for free because having many users, and high familiarity with Microsoft’s products is an important factor that plays into which tools corporate users buy.

That is why Microsoft is not giving up on consumer versions of its products, even though some of them can hardly be called successful. For example, its free consumer version of Office 365 has a far smaller number of users than around 3 billion users of Google’s suite of productivity apps.

Google’s advantage is clearly its Android platform since Android users generally need a Google account, and many of Google’s productivity apps are preinstalled on Android phones. Unfortunately for Google, its dominance in free consumer tools does not translate to many paid users. Microsoft continues to dominate for paid accounts as its $45bn revenue from Office confirms.

Microsoft introduced new Windows 11 that are slowly increasing its share on Windows based consumer devices. Interestingly, Windows 11 is having consumer version of Teams preinstalled.

Windows also has Microsoft Edge browser preinstalled since version 10, with Bing as a default search engine. Microsoft is not shy to push it to Windows users aggressively, including nudges within Windows to log in to Microsoft account and use Microsoft’s own cloud services.

Overall, Microsoft’s consumer business is full of failures. And I don’t mean only because they failed in the smartphone OS business. Even on PCs, platform firmly under Microsoft’s control, it is a failure that they cannot persuade Windows users to stay with tis default Edge browser and Bing search engine.

For some reason, consumers don’t like those products, and instead of using them, they go through the hassle of switching to Chrome and Google Search on Windows.

Above mentioned Edge/Bing failure is a revenue hole for Microsoft. By not fixing it, Microsoft is simply handing over, according to my estimate, around $25bn in annual revenue to Google.

📦 What Products & Services Microsoft Offers and How It Makes Money from Them

Microsoft offers many products & services that can be categorized into four segments based on their value to customers.

- Intelligent Cloud (Azure, Server Products)

- Productivity and Business Processes (MS Office, Dynamics)

- General Computing (Windows ecosystem)

- Gaming (Xbox)

The segments above are primarily based on three Microsoft official segments they use in their financials. The only difference is that I split their weirdly named “More Personal Computing” segment into separate General Computing segment and Gaming segment. I think that separating gaming makes sense since it is the only clearly consumer-focused group of Microsoft products.

Focusing on these Microsoft product segments and not individual products themselves is crucial because these segments very well represent Microsoft’s customer needs. Each segment can be seen as its own ecosystem of products and services and even as a separate business model. Explaining Microsoft through individual products would be a flawed approach, where we would not see the forest for the trees.

Business customers, especially the medium and large ones, are at the core of what Microsoft focuses on. Whatever need arises for these customers in the future, I will bet that Microsoft will try to address it and offer a solution. At least if there will be money to make from it either directly or indirectly.

If the solution will be the introduction of a new product or some functionality within an existing one is irrelevant detail here. That’s why focusing on segments rather than individual product makes so much sense here.

The first two segments that Microsoft calls “Intelligent Cloud” and “Productivity and Business Processes” both focus mainly on business customers. What separates them is the different needs they solve.

The Intelligent Cloud segment focuses on backend infrastructure and tools used mainly by developers, and the “Productivity and Business Processes” segment is mostly about tools for “regular” business users.

The third group that I named “General Computing” equals Microsoft’s official “More Personal Computing” segment without gaming-related products. This segment covers mainly Windows OS and related ecosystems of tools and services.

If we measure it in the number of users, consumers outnumber the business users of this product. However, the majority of revenue is still coming from businesses.

The fourth segment, “Gaming,” differs not only in customer needs but is also a single purely consumer-focused business Microsoft has.

The visual below tries to go one layer deeper into the Microsoft revenue model and show product groups’ main revenue streams. It also shows what the core drivers of that revenue are.

Note that Azure and Server Products are two different categories here, and gaming numbers do not reflect the recently announced Activision Blizzard acquisition, which will put Gaming revenue very soon above that of Windows OS.

Let’s now look more in detail at each individual segment and see what exactly is within them and how those products and services are tied together.

How Microsoft Makes Money from Intelligent Cloud (Backend Infrastructure & Tools)

The first segment of Microsoft’s products and services that we will look into is the “Intelligent Cloud .”This segment includes products like Azure, SQL Server, and Window Server used to help companies with their infrastructure needs and manage their cloud or on-premise infrastructure productively and securely. These tools are usually used by developers and not by regular business users.

Microsoft makes money from Intelligent Cloud products and services mainly by renting out its cloud (Azure) infrastructure and connected tools (~44bn of revenue) and also by licensing traditional server software like Microsoft SQL Server or Windows Server (~$24bn).

A smaller part of the Intelligent Cloud segment is support and consulting services, which earned $7bn in 2022.

Microsoft earns $15bn a year from different security solutions. However, this amount is not additional to Intelligent Cloud revenue. It is not reported officially in Microsoft’s financials and is probably an estimate of all security-related revenue from tools included across Azure, Microsoft Office, and other products.

Microsoft is becoming more and more active in cybersecurity. Apart from some of its more advanced tools that have been available for some time already, the company introduced Microsoft Defender for Business recently, which is accessible even for small businesses. Microsoft also announced different levels of new services that combine its AI-based cybersecurity services with real-life security experts.

Azure and Server Products are a core part of the Intelligent Cloud segment. Both in its importance and also in revenue they are generating.

I have to admit I am not a big fan of how Microsoft named this segment “Intelligent Cloud” since it is too general, and I would much prefer something more descriptive like “backed infrastructure and tools .”But that would make things even more confusing, so I will stick with the “Intelligent Cloud” naming in this article.

Azure

Azure is an ecosystem of different infrastructure services and backend tools. You can rent an Azure virtual machine from Microsoft, which is the most basic type of infrastructure as a service (IaaS).

Or you can just run your code or database in the cloud without even worrying about setting up a virtual machine at all, which is often called platform as a service (PaaS). But Azure is much more than this.

Azure is an ecosystem of infrastructure and cloud tools to run on it. For example, with a product like Azure Synapse, Azure Purview, and Azure Machine Learning, you can run your data storage & advanced analytics in the cloud and manage your data sources across different clouds or even your on-premises servers.

Microsoft makes around $44bn a year from Azure by charging its customers fees based on how many resources they use. A resource can be data storage, computing time, number of transactions, or traffic volume. Price very much depends on the sophistication of the service.

The more sophisticated services are more expensive, making it more profitable for Microsoft. And I think it is essential to realize that this is where the future of a successful cloud business model is.

It is not in the “naked” infrastructure that will become more and more commoditized. The future is in offering integrated solutions that businesses need and providing necessary cybersecurity protection as a part of it.

Software is where Microsoft excels. With Microsoft’s early lead in hybrid solutions, where you can mix cloud resources with on-premises servers and still manage it as one infrastructure through Azure tools, I understand why Microsoft is rapidly gaining market share in the cloud.

Microsoft’s market share in the public cloud, which includes both IaaS, PaaS, and hosted private cloud, was 21% compared to 33% for AWS. Other market share numbers are floating around, which put AWS far ahead with around 40% market share and Microsoft at 20%, but it measures only “naked” cloud (IaaS) and not the full range of public cloud products.

Server Products

![]()

Let’s now refocus on a second core part of Intelligent Cloud products and services, which are different server products Microsoft offers.

Microsoft makes around $24bn annually from Server Products, predominantly by licensing SQL Server and Windows Server. These products are not used only as on-premise servers but more and more also as part of cloud infrastructures, even the ones running on non-Azure clouds.

Even though SQL Server and Windows Server can be considered “old school” on-premise products that do not belong to a new cloud-centered world, the reality is different. For businesses that want to move into the cloud but have some dependencies that require them to run their applications on Windows Server, it might be more beneficial to keep using Windows Server in the cloud.

This benefit is because they can keep running Windows Server in the cloud for some time until switching to more modern cloud tools makes business sense. It is not an ideal solution, but it makes switching to the cloud easier and less time-consuming.

These companies can realize partial benefits of switching applications to the cloud more quickly and have the option to rebuild them with native cloud tools later. Microsoft will even sweeten the deal by allowing businesses to bring their existing licenses to the Azure cloud. The similar is true for SQL Server.

Market share for both products is still significant, even though Linux took the lead from Windows Server a long time ago.

Cloud and hybrid use for Windows Server and SQL Server are why licensing revenue is still slowly growing each year. It is only growing in the single digits, which is nothing compared to Azure growth of around 50%, but still, it shows that even not-so-sexy parts of Microsoft are still humming along nicely.

Another way to look at Server Products is that current on-premise server product customers are potential future Azure services customers.

The Server products category, as Microsoft defines it, also includes developer tools like Visual Studio or GitHub. Revenue coming from it is nothing to ponder about, but these products are an important part of the ecosystem.

How Microsoft Makes Money from Productivity & Business Processes Tools

Microsoft productivity and business processes tools consist of Office, Dynamics, Power Platform, LinkedIn, and newly Viva. These tools are focused mainly on business customers and their productivity needs. Their focus is also mainly on end business users and not developers.

Microsoft makes money from productivity and business processes tools primarily by selling subscriptions and licenses for Office ($45bn revenue) and selling subscriptions and ads on LinkedIn ($14bn). Microsoft also earns money from Dynamics and some Power Platform tools ($5bn)

I will not be able to go through each individual product in this article. Still, all the different productivity tools might be grouped into Office tools, including Teams, Power Platform Tools, Dynamics, and LinkedIn.

These tools cover nearly every possible business productivity need from document creation, email, messaging, audio, and video communication. It also includes tools for dealing with workflows and processes, automation, hiring, training, etc. The business model within this ecosystem is primarily subscription based.

Each product within this segment is a standalone product. But Microsoft built-in an integration between them strong enough that they create one large productivity ecosystem.

In the middle of all those tools is Teams, a Microsoft communication and cooperation too. Teams have become one of the most important apps within this ecosystem. The one you spend a lot of time in.

“Every organization today needs a digital fabric to connect and empower everyone inside and outside the organization, from knowledge and frontline workers to customers and partners.

At the center of this digital fabric is Teams, which surpassed 270 million monthly active users this quarter.

Organizations are using Teams to run their business with collaborative applications that bring business process data right into the flow of work. “

— Satya Nadella, CEO of Microsoft, Earnings Call in January 2022

Microsoft touts that its ecosystems are open and allows integration with third-party products. Relatively speaking, it is true. Despite that, Microsoft products are still sticky. If Microsoft offers the additional product that the company needs, it is easier to stay within the Microsoft ecosystem than deal with integrating with another provider.

So far, Microsoft Office, which consists of a wide range of apps and tools, is the main revenue generator for Microsoft. And although Office has been the bread and butter of Microsoft’s profitability for decades, it still is doing very well. Office revenue was growing in double digits for several years.

Dynamics is another range of Microsoft’s products. Its revenue is only in single billions of dollars, but it grows quickly and has a promising future. Dynamics is a relatively new product category for Microsoft and has so far low market share compared to Salesforce, which is the clear market leader in this category.

There is also a relatively new Microsoft Viva product, which, together with LinkedIn, seems like an attempt for Microsoft to make things much smoother for HR departments and employee training. So far, HR departments have had to look for a solution somewhere else or build their own internally.

How Does Microsoft Make Money from General Computing (Windows Ecosystem)

Windows operating system is at the center of the General Computing ecosystem that can be, to a certain extent, also considered productivity related. Apart from Windows, it contains tools like Edge browser, Bing search engine, and Microsoft’s own hardware products. Hardware is represented mainly by Surface devices, which, with the exception of Surface Duo, are based on the Windows operating system.

Microsoft makes money from Windows and its ecosystem of tools mainly by selling Windows licenses and subscriptions ($25bn revenue). Microsoft also makes money from Search advertising through its Bing search engine ($12bn) and selling hardware ($7bn).

Microsoft’s official segmentation that it reports in its financials does not include Windows and related desktop tools as a standalone segment. Microsoft bunched these tools together with Gaming into the “More Personal Computing” segment.

I get that Windows is also used by consumers, similar to gaming but nearly 80% of the revenue comes from commercial Windows licenses or Professional OEMs versions and other non-consumer related revenue. Therefore it does not make too much sense to bunch them together.

Windows became less important for Microsoft than a decade ago when it was a crucial part of Microsoft’s total revenue and indirectly was a driver of Office revenue. Everything was linked to how many Windows PCs were running in the world.

Despite all that decline in importance, Windows was still business with $25bn of direct revenue annually in 2022. Its share on the total revenue is decreasing, but the absolute amount is still growing each year, albeit slowly.

I also think that Windows as a platform is more important for Microsoft than would its current 12% share of revenue suggest. Without Windows, many other existing or potential revenue streams would simply dry out. From Windows based servers used on-premises or in the cloud to Windows 365 Cloud PCs.

Microsoft’s market share of Edge browser or Bing Search engine would also suffer. However, it is currently tiny compared to the potential Microsoft has there as the owner of the Windows platform. Fixing Edge and Bing products and their popularity should be on top of the company agenda. Until they do that, Microsoft is simply handing over, according to my estimate, around $25bn of annual revenue to Google.

Microsoft browsers’s market share on desktops was around 10% worldwide and 14% in the US.

Like other Microsoft ecosystems, the Windows ecosystem is sticky, and Microsoft is trying to make it more sticky by offering a free version of its tools for desktop use.

An example is Power BI or Power Automate, which are powerful tools that anyone can use in their basic version for free. Wide adoption of these tools among businesses helps with stickiness to Windows OS. This stickiness makes Microsoft’s position stronger when companies need to switch to more advanced paid versions of this product.

We can also see an even more apparent approach in Windows 11, where a basic version of Teams is integrated into the operating system.

How Does Microsoft Make Money from Gaming (Xbox)

The gaming business is something Microsoft was involved in for ages, but it was never a huge part of how Microsoft made money. Just a few years ago, the future of gaming within Microsoft was quite cloudy. At least from the outside, it was not clear how Gaming fits into Microsoft’s strategy and if it is an attractive enough opportunity to keep investing in it. Today we can see more clearly that the sizable opportunity might be there, and Microsoft is making pretty aggressive moves within gaming.

Microsoft makes money from gaming by selling Xbox consoles at a loss and then making money primarily by taking a 30% commission from transactions in Xbox Store. Microsoft also makes money by selling its Xbox Gold and Game Pass subscriptions and selling games developed by its own gaming studios.

Apart from taking a commission from Xbox Store transactions, Microsoft earns money by selling different subscriptions to gamers. Xbox Live Gold subscription is a must-have $59.99 yearly add-on for anyone who wants to play non-free games in multiplayer mode on the Xbox console.

Xbox Games Pass is another subscription service with different tiers where the most expensive one can give you access to hundreds of games. It also includes Xbox Cloud Gaming, currently in beta, which allows you to stream games to your smartphone, tablet, and other devices without downloading them.

The older Xbox Live Gold subscription has around 100 million monthly active users, and a more recent subscriber count for the Xbox Game pass was 25 million.

Microsoft made $16bn from Gaming in 2022, representing a 8% revenue share. From that, $12.6bn came from content and services and $3.7bn from hardware. The main drivers of content and services revenue were commission from digital transactions, Xbox subscriptions, and also Microsoft’s own games sales.

Microsoft’s current gaming business model seems to be based on selling hardware, losing some money on it, and then really making money by selling games to users of Xbox consoles. The more consoles are sold and used, the more money Microsoft will make.

Microsoft was not a market leader in console sales historically. That title belonged to Sony and its PlayStation console. If we compare only PlayStation and Xbox consoles, PlayStation has always had a higher market share than Xbox. This was true mainly worldwide but also in the US, where Microsoft had a better position but still was trailing behind PlayStation.

In 2021, shortly after a new generation of consoles hit the market, Microsoft gained market share relative to Sony. Xbox consoles market share worldwide was 39% in 2021 and in the US 48%. This was so far the best full-year result for Microsoft, but still, Sony took the crown.

Yet, based on the numbers for the beginning of 2022, it looks that Xbox might finally get ahead of PlayStation in the US, and even for worldwide sales, Microsoft is running neck to next with Sony. So far, it is not possible to say if it is thanks to Xbox having better success among gamers or if it is about supply chain problems hitting harder on Sony than Microsoft.

As an additional income, Microsoft charges Xbox users a fee to access online gaming options for paid content. When you buy games from the Xbox Store, you cannot access online multiplayer functionality, and you have to subscribe to Xbox Live Gold or Xbox Game Pass to get access to it.

Until recently, this was true for any game on Xbox consoles, but Microsoft changed their rules, and free games are since really free without a need for any additional subscriptions.

Microsoft is making many changes in its gaming business. Its business model is shifting from a hardware-based “walled garden” style ecosystem to a more open platform exosystem that is available from any device, not only for Xbox consoles.

I have already mentioned that both Microsoft and its rival Sony introduced a new generation of consoles at the end of 2020, but there are far more important changes than the new consoles.

The first significant change is that Microsoft invested heavily in acquiring several gaming studios to strengthen its own portfolio of games. Microsoft then offers those games as part of its Game Pass subscription.

The strategy behind this is to make all these directly owned games available in Game Pass, which should then attract subscribers. With many subscribers, after it is a proven successful platform, the expectation is that other game developers will be interested in joining in too.

“We invest in our first-party [games] as a catalyst for growth. In the end, I do know that most of the games, just like most of the games that are played on an Xbox, should be third parties. Those third parties have to build a healthy business on Game Pass. Otherwise, it doesn’t work.”

— Phil Spencer, VP of Gaming at Microsoft, Decoder podcast by Verge

So far, Microsoft was acquiring mostly smaller studios, and the most sizable ones were Mojang and ZeniMax Media. That was the case at least until recently. In January 2022, Microsoft announced the acquisition of Activision Blizzard for $75bn.

It is the largest Microsoft acquisition ever, and it fits Microsoft’s pattern of strengthening its own gaming content. If this acquisition gets approved by regulators, gaming will have a more significant share of Microsoft revenue than Windows.

But buying studios to bolster subscriptions to Game Pass for a monthly fee only to a limited number of Xbox console users might not be enough profitable strategy to justify these acquisitions. Microsoft’s ambition here is to make Xbox Game Pass subscription successful outside consoles too. This includes PC gaming and especially gaming on smart devices.

My point is that this is not just about fighting with Sony for console market dominance anymore. Microsoft is trying to lead an attack on multiple fronts to break into other areas of gaming outside its Xbox consoles.

That makes perfect sense when you realize that around half (52%) of gaming market revenue is coming from mobile devices, and the rest is split between consoles (28%) and PCs (20%).

“The big bets we have made across content, community, and cloud over the past few years are paying off.”

…

” And with our planned acquisition of Activision Blizzard, announced last week, we are investing to make it easier for people to play great games wherever, whenever, and however they want, and also shape what comes next for gaming as platforms like the metaverse develop.”

— Satya Nadella, CEO of Microsoft, Earnings Call in January 2022

PC gaming is the obvious opportunity, which Microsoft neglected for years and now is in the situation where the leading gaming marketplace on Windows PC is Steam. Changing that won’t be easy.

Microsoft is trying to gain some market share by taking far lower commissions from PC games (14% vs. standard 30% charged by competition) and offering an Xbox Game Pass subscription, which includes the option to play Game Pass games on any platform, including PC.

Even more challenging will be Microsoft’s ability to gain share in smart devices gaming. Microsoft is not in control of its own smartphone ecosystem, making pushing into smartphone gaming tricky. So far, it looks like their strategy is based on Xbox Game Pass and Xbox Cloud Gaming.

Xbox Cloud Gaming is a service introduced by Microsoft for Game Pass subscribers to play Game Pass listed games from any device without downloading them. Games run on a server in Microsoft’s data centers, and screen output is then streamed on your tablet, phone, or another device that people already have in their home, like a TV.

Based on that, Microsoft’s potential for Game Pass might multiply because, suddenly, Microsoft is not limited to Xbox console users or PC users. Its customer can be anyone with a phone, tablet, or TV.

This looks like an immensely promising opportunity through which Microsoft’s gaming acquisition spree can be justified. Although, in practice, this opportunity will be pretty complicated to pull off. It requires high-speed internet with low latency, which is not the case everywhere, and without it, the cloud gaming experience can be highly frustrating.

On the other hand, Microsoft is just at the beginning of cloud gaming. If some company out there is in a position to figure out a way to make cloud gaming work, who better than Microsoft.

What I have in mind is that Microsoft as an owner of in-house gaming solutions, Azure cloud infrastructure, and Game Pass subscription service is in a unique position to experiment and deliver a more advanced solution for cloud gaming. It might be more about using cloud resources and limited device computing power to make sure latency issues are minimized.

If Microsoft somehow manages to crack this problem, they have an infrastructure, customer base, in-house gaming studios, and lobbying power to push it forward. With this in mind, Microsoft’s focus on gaming and level of investments starts to make sense.

Microsoft will need to overcome the obstacle that mobile gaming is currently running on platforms owned by Google and Apple, and they will protect their lucrative source of profits.

Microsoft is trying to position itself as a “good” tech giant, at least compared to Apple, Facebook, Google, and Amazon. So far, it kind of worked, and when US Congress grilled tech companies CEOs in July 2020 during its hearing on the “Online Platforms and Market Power,” Microsoft was not invited.

It will be interesting to monitor how long this Microsoft position as a “good” tech giant will last and how much pressure will intensify between Microsoft and Google, Apple, and other tech giants.

⚙️ What Microsoft Actually Does to Deliver Its Products and Services to Customers?

Microsoft is a predominantly software company, and therefore its core activities are centered around designing, developing, testing, and servicing software products. The last decade brought another dimension to Microsoft’s business model, which is a need to build and operate a worldwide network of data centers.

Apart from building software and data centers, Microsoft, like any company, has to be able to promote and sell its products. Therefore, a big chunk of its activities is also about sales and consulting.

Let’s now look into the core parts of Microsoft’s inner activities necessary for its business to function. I will also touch upon resources and partnerships it uses to deliver value to its customers.

Developing Software

![]()

Microsoft is, first and foremost, a software company. Yes, there are also other activities, like building data centers or developing hardware, that I will get to later, but developing software is the core activity of Microsoft and is also the core of its profits.

Developing software requires first finding a need from customers that are also willing to spend money to satisfy that need. Microsoft’s business is mostly about business customers, but some of Microsoft’s software serves both business users and consumers. In the case of gaming, it is purely consumer-based.

In the recent year, Microsoft scored a lot of points on the market by introducing products like Teams or Power BI that successfully captured customer attention and were quickly adopted. So unless Microsoft was extremely lucky, it had to do something well in identifying what its current and potential customers needed.

The journey from an idea of the product to something delivered to the customer is a long one. It starts with the design phase, which includes both technology and user experience design. Then I continue by writing the code, testing, and multiple rounds of fixing and rewriting.

Even after the software product is successfully launched, a workforce is still needed to keep it running and develop it further based on customer feedback. Microsoft needs to have people able to fix bugs that are discovered and patch security holes quickly. Somebody also has to provide customer support.

Remember that all of the above is happening simultaneously for the myriad of products Microsoft offers to its customers. It also includes gaming which will become an important part of Microsoft if the announced Activision Blizzard acquisition gets approved.

Therefore, to do all of that, Microsoft needs an army of engineers, designers, testers, and support employees. Moreover, Microsoft also requires a lot of managers and coordinators to make sure all those developing activities are synchronized among different teams.

Microsoft had 221 000 direct employees in 2022, and 73 000 were focused on product research and development.

Software development is not the only activity of Microsoft, and therefore not all R&D employees are developing software. But most of them are since that is the core of what Microsoft does. Note that those employee counts do not include contractors that are not direct employees.

In dollar amount, Microsoft spent $25bn annually in 2022 on research and development, and nearly all of it was spent on employee compensation.

Besides R&D, Microsoft employs 85 000 people in operations. Again, this includes also people servicing data centers and hardware products, but software-focused operations are also part of it.

Building and Operating Datacenters

![]()

Microsoft is a software company and mainly of cloud-based software. However, even cloud-based software has to run on some physical hardware somewhere. That’s where Microsoft’s network of data centers comes in.

As a provider of cloud infrastructure & cloud-based software, Microsoft needs to have enough data centers around the world that will handle its customers’ computing needs.

A lot of data centers mean the necessity to buy many processors, memory chips, and network equipment. Microsoft also needs land and buildings to house the computing equipment and ensure a reliable energy source nearby and backup generators. Of course, everything has to be very secure.

Simply said, many things have to happen to make sure that these data centers can run securely 24/7.

Datacenter infrastructure and related networking of those data centers together cost a lot of money to build and operate. Fortunately for Microsoft, its cash flow is strong enough to finance this investment and still return cash to investors as dividends or share buybacks.

Customers’ cloud computing needs continue to grow rapidly, and therefore Microsoft continues to build new data centers around the world. So far, there is no sign that this trend should change.

Building data centers is a relatively new activity for Microsoft. Historically, Microsoft assets were mainly about intangibles like patents, brands, and other intellectual property. But since cloud software started to gain track, it is interesting to see how Microsoft is a more “asset-heavy” company.

This change can be seen when looking at Microsoft’s balance sheet and the proportion of property and equipment in time.

Microsoft datacenter network is roughly in line with AWS, and both companies service hundreds of datacenter around the world. Both AWS and Microsoft are trying to promote their network as the biggest, promoting the metrics each company is good at. Microsoft usually touts its number of regions and AWS its number of availability zones.

Sales & Promotion

![]()

Without Microsoft sales and promotional activities, having a great infrastructure and building great products would not be worth much.

Microsoft’s internal sales team, together with a network of its partners, is one of Microsoft’s core strengths. It is a full-fledged “sales machine” that includes Microsoft’s own staff and also an army of different consultants, resellers, and vendors that sell and promote Microsoft-centered solutions.

I see Microsoft’s “sales machine” as one of its core competitive advantages, and there are different dimensions to it.

Firstly, Microsoft has strong historical sales relationships both with its partners and directly with customers. This puts Microsoft at an advantage by itself.

Secondly, at least as I see it from the outside, sales and sales network and their importance for company success is an integral part of company DNA. 47 000 people are working in sales and marketing at Microsoft, and it is hard to find many other companies where so much credit is given to the sales team and partners publicly.

For example, the quote below is from Microsoft’s earnings call and depicts how Microsoft’s CFO introduced company great company results.

“Our sales teams and partners delivered a strong start to the fiscal year.”

— Amy Hood, CFO of Microsoft, Earnings Call October 2021

The sales team always had a big role in Microsoft’s organization and not always in a good way. Yet, it seems that changes to sales organization by CEO Satya Nadella worked. At least from the outside, misalignment between sales and engineering is not noticeable; quite the opposite.

Part of sales & promotion activities are also activities focused on promoting Windows, Azure, and Xbox based ecosystems by providing tools and resources for developers and pushing adoption of these ecosystems.

Important partnerships that Microsoft needs to navigate are its relationship with Google and Apple as owners of the Google Play Store and AppStore. This is the crucial way Microsoft can distribute its products to smart devices as it does not have its own smartphone OS. Microsoft’s intention seems to be to push its Xbox gaming to these app stores, resulting in more clashes between Microsoft, Google, and Apple in the future.

Other Things Microsoft Does to Deliver Its Products and Services to Customers

I think all the activities mentioned before are the main ones. Obviously, Microsoft is such a large company, with such a broad product offering, that far more activities happen within it. They might not be as crucial for Microsoft as the ones I already mentioned, but the size of that operation would still be considered huge for many other smaller companies.

For example, hardware is not the core of what Microsoft does. Still, there are people, processes, and partnerships within Microsoft that allow it to design, develop and deliver to customers their Surface computers, keyboards, computer mice, and now even phones running on Android.

Partnership with manufacturers is how Microsoft distributes its Windows operating system. Multiple manufacturers called OEMs (Original Equipment Manufacturers) sell their desktops and notebook PCs with Windows already preinstalled, and this relationship is very fruitful for Microsoft.

Another Microsoft activity that is worth mentioning is its role as an investor in different startups through its venture capital arm called M12. There is also ScaleUp, Microsoft’s accelerator.

📚 Resources & Links

Related Articles

- Microsoft Financial Statement: Overview & Analysis

- How Facebook Makes Money: Business Model Explained

- Microsoft Revenue Breakdown

- A detailed breakdown of Microsoft’s revenue by product, segment and geography

- Who Owns Microsoft: The Largest Shareholders Overview

- Overview of who owns Microsoft and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Other Resources

- Microsoft’s Annual Financials Statements (K-10)

- Microsoft’s Investor Relation website

- Official Microsoft Blog

Disclaimers

- At the time of writing this article, I had a long position in Microsoft.

- The article was updated to include Microsoft’s 2022 fiscal year financials

- Although I use third-party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site. There is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.